Office and retail properties continue to be in high demand due to their high sale prices and low capitalization rates. While the industrial market has performed the poorest for number of transactions, sales volume, and price per square foot. Learn which property types to invest in Q4 2015.

As the 4th quarter approaches, we highlight investment sale activity across San Diego County and across the three major commercial property types of office, retail, and industrial.

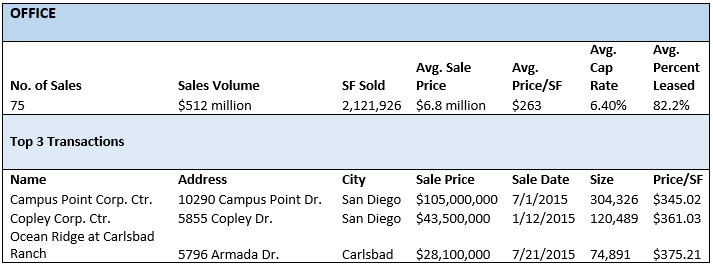

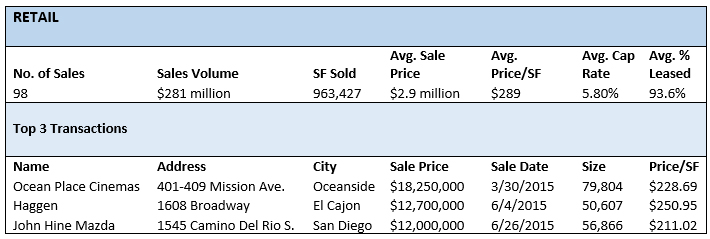

The following tables detail single-building investment sales in San Diego County in 2015 to date (Source: CoStar).

Of the three property types, the retail market had the highest number of transactions with 98 sales since January 2015. In addition, the average price per square foot was also highest for retail properties, and the average capitalization rate was the lowest at 5.80%.

The office market posted the highest sales volume with $512 million worth of property sold to date, with the average sale price of $6.8 million being the highest of the three property types. In terms of total square footage sold, the office market came in first with almost more than a million square feet sold than industrial, which came in at second out of the three property types.

The industrial market had the lowest number of investment transactions, lowest sales volume, and lowest average price per square foot. However, these results are to be expected due to the increased demand for both office and retail properties.

Summary

The highest single-building sales to date occurred in the office market, with sales ranging from $28,100,000 to $105,000,000. The retail and industrial property types each had their top three sales coming in under $20 million. Sales occurred throughout Central to North County, with no top sales occurring in South San Diego County.

As the data shows, office and retail properties continue to be in high demand, as evidenced by the high sale prices per square foot and low capitalization rates. Although fewer industrial investment sales have occurred, average capitalization rates are still below 7.0%, indicating that San Diego County commercial real estate investors will continue to demand this type of product.

Sources: