Based on research compiled by Integra Realty Resources – San Diego, commercial real estate market conditions are expected to improve across all property types in San Diego County. The following charts detail current rental and vacancy rates for office, retail and industrial property types in San Diego in comparison with the rest of the region and the United States. Following these current snapshots is a 12-month forecast of the change in market rent, the amount of square feet absorbed, the amount of construction completed, and the estimated allowance for tenant improvements.

Office

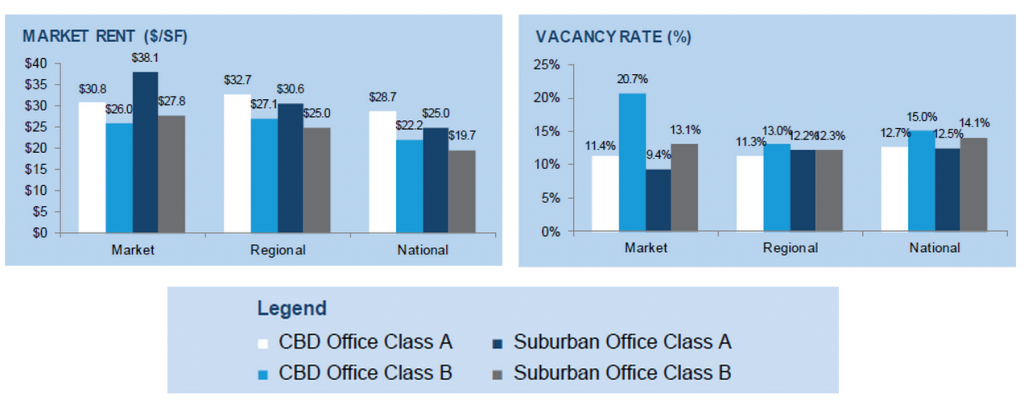

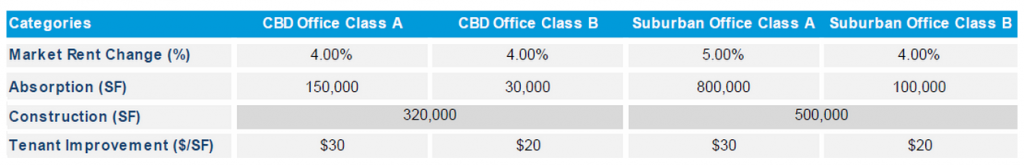

From a rental standpoint, the San Diego office market is generally in line with the rest of the region. The Class A suburban office market is posting significantly higher rental rates and lower vacancy rates than the regional and national data, in part due to increasing demand in the UTC and Del Mar Heights submarkets.

Overall, rental rates are expected to increase between 4% and 5% (depending on property type) over the next 12 months.

Retail

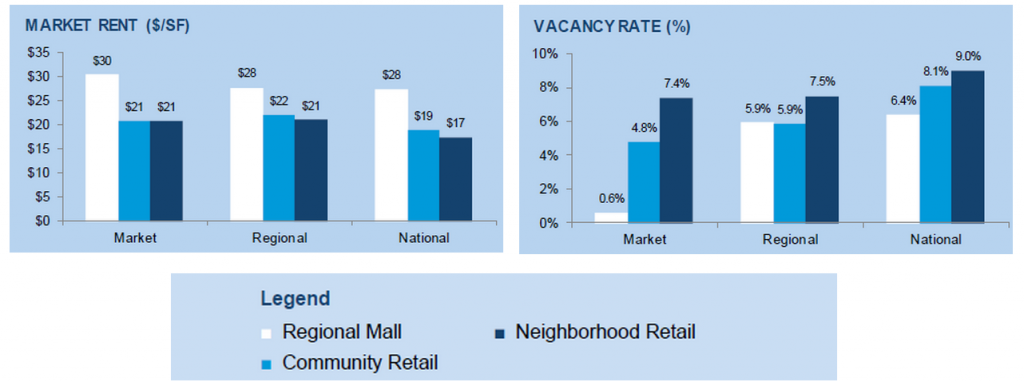

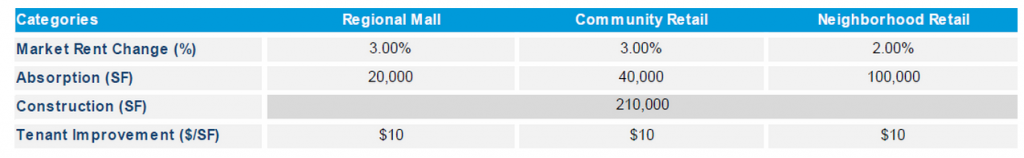

Most of the San Diego retail data is in line with the regional and national figures, but the notable trend is regional mall vacancy in San Diego, which currently stands at less than 1%. However, this figure may change when Westfield UTC completes its 750,000 square foot expansion but nevertheless San Diego’s regional malls continue to outperform the other market regions.

Rental rates are expected to increase at modest rates of 2% to 3% over the next 12 months.

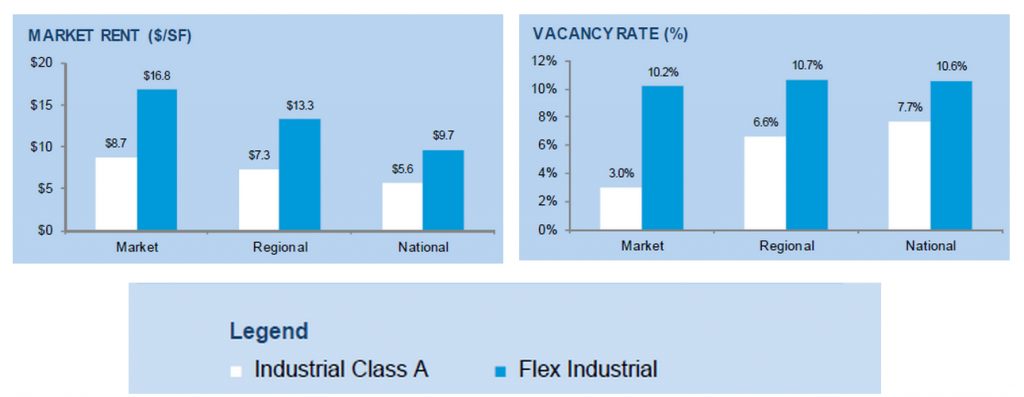

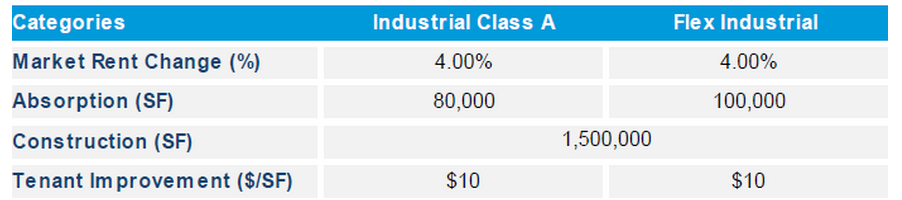

Industrial

The notable trend for San Diego industrial space is the low vacancy rate for Class A industrial properties, which is expected due to limited product currently available and limited product expected to be delivered.

Market rent is expected to grow at a rate of approximately 4% for this space and flex space.

Sources: