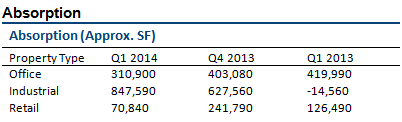

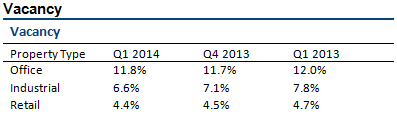

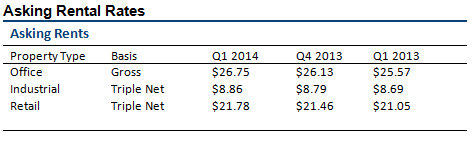

The following tables, (consisting of market data from CoStar Group, Inc. compiled by Integra Realty Resources – San Diego), highlights absorption, vacancy, and asking rental rates for office, industrial, and retail property types.

All three sectors had positive absorption this past quarter, which continues the trend from the previous quarter. With the exception of industrial, positive absorption was also experienced one year ago. While negative industrial absorption was reported in Q1 2013, this amount is small; additionally, out of the last 12 quarters in the San Diego industrial market, only two had negative absorption.

Compared to the end of 2013, the change in vacancy has been small, varying from 0.1% to 0.5% across the three property types. Out of office, industrial and retail, only two reported a decrease in vacancy, with the office market vacancy increasing slightly. Compared to one year ago (as well as previous years not shown in the table above), vacancy rates are continuing to decrease.

The most positive data reviewed is the average asking rental rate for office, industrial, and retail space. Rental rates for all three property types is continuing to increase in the first quarter of 2014 compared to the end of 2013 and to one year ago.

Summary

Overall, the office, industrial, and retail markets in San Diego are continuing to improve based on market information reported in the first quarter of 2014. The trends for absorption, vacancy, and rental rates are generally positive, which will favorably impact commercial real estate in the near future.

Sources:

CoStar Group, Inc.

Compiled by Integra Realty Resources – San Diego