Through the first half of 2014, market conditions for industrial properties in the San Diego market (which include warehouse and flex/R&D properties) have remained relatively stable.

Vacancy and Rental Rates

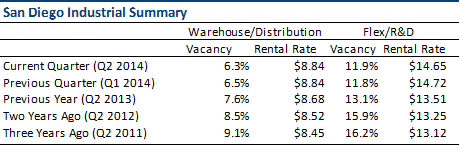

The table below summarizes vacancy rates and rental rate data from CoStar Group compiled by Integra Realty Resources – San Diego.

The current vacancy rate for warehouse/distribution space is approximately 6.3%, while the vacancy rate for flex/R&D space is 11.9%. Compared to last quarter, there is not much change; the vacancy rate for warehouse and flex space varied 0.2% and 0.1%, respectively. However, the vacancy rate for both industrial types has steadily improved over the past 3 years.

The average asking rental rate (gross) is $8.84 per square foot per year for warehouse properties, which has not changed from the last quarter. Over the past three years, the rental rate has been increasing slowly at about a rate of less than 2% per year. However, the flex rental rate dropped slightly from the previous quarter; the current rental rate is $14.65 per square foot per year, which is less than a 1% decrease from the previous quarter. That being said, there was a significant increase in the past year with average rental rate increasing almost 9% from 2013 to 2014.

Completions and Net Absorption

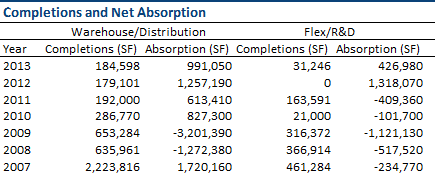

In addition to the above indicators, overall completions and net absorption figures from 2007 to 2013 were reviewed for Warehouse/Distribution and Flex/R&D property types. The following data is from CoStar Group and compiled by Integra Realty Resources – San Diego.

Construction began slowing down for industrial properties as the economic recession was felt in the late 2000’s. While development for warehouse properties has remained relatively consistent for the past three years, flex development has varied.

As with completions, absorption was affected by the latest economic recession with negative absorption numbers from 2007 to 2009 for warehouse properties and shown in 2007 to 2011 for flex properties. The warehouse market appears to be recovering at a faster rate than flex space, as evidenced by four years of positive absorption compared to two years for flex.

Conclusion

Similar to other commercial property types in San Diego, the industrial market continues to show signs of improvement compared to recent years. While year-to-date data indicates a slight stall in improving market conditions, the overall outlook for the industrial market is positive.

Sources:

CoStar Group, Inc.

Compiled by Integra Realty Resources – San Diego