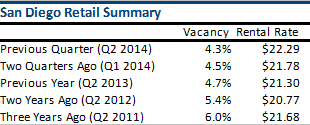

Based on the Vacancy Rate and Rental Rate Summary table below (which includes market data from CoStar Group compiled by IRR San Diego), the San Diego retail vacancy rate from the last full quarter was approximately 4.3%, which is generally similar to two quarters ago and to one year ago. Over the last three years, the retail vacancy rate has decreased by about 1.7%. The average asking rental rate (on triple net basis) is $22.29 per square foot per year, a 2.34% increase from the previous quarter, and a 4.65% increase from one year ago.

Vacancy Rate and Rental Rate Summary

The vacancy rate for the San Diego retail market has overall been relatively low in relation to other property types. In fact, based on a review of the vacancy rate data over the past eight years, the highest vacancy rate was reported at 6%. While the vacancy rate may be higher (or lower) in certain submarkets, there is generally high occupancy for San Diego retail properties.

Overall rental rates have been increasing over the past two years following a period of decline that began in 2008, when the average rental rate was reported to be $25.05 per square foot per year. Rental rates reached its lowest in Q4 2012, where the average was $20.69, a 17% decrease from the 2008 peak. Since then, rates have been increasing at a healthy rate year over year.

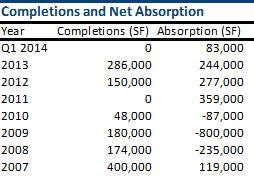

Completion and Net Absorption Information

As shown in the table above (which includes market data from REIS, Inc. compiled by IRR San Diego), retail construction slowed in the late 2000’s as the economic recession was felt. By 2011, there was no completed retail properties reported. However, completions resumed in 2012 with approximately 150,000 square feet completed. In 2013, this figure almost doubled with approximately 286,000 square feet of retail space completed. While REIS has reported no completed projects in 2014, CoStar reports that approximately 589,000 square feet is currently under construction.

As with completions, absorption was affected by the latest economic recession with negative absorption numbers from 2008 to 2010. However, San Diego has experienced steady positive absorption for the last three full years and is currently positive in 2014.

Summary

Based on the market indicators above, the overall San Diego retail market has experienced positive conditions over the past three years. Based on the data presented, demand for retail space continues to increase, which will have a positive effect on property values in the near future.

Sources:

CoStar Group, Inc.

REIS, Inc.

Compiled by Integra Realty Resources – San Diego