With talk about a frothy commercial real estate market, what trends do the retail and industrial sectors have to hold? According to a recent ICSC NOI+ conference held at the Dallas Hyatt Regency, a panel of leading investors and investor advisers imparted that retail real estate prices are plateauing and the number of bidders for available properties are down. It seems that the industrial market is taking a hint from the retail sector, as the NAIOP Research Foundation predicts a slowdown in industrial space demand for 2016 and beyond.

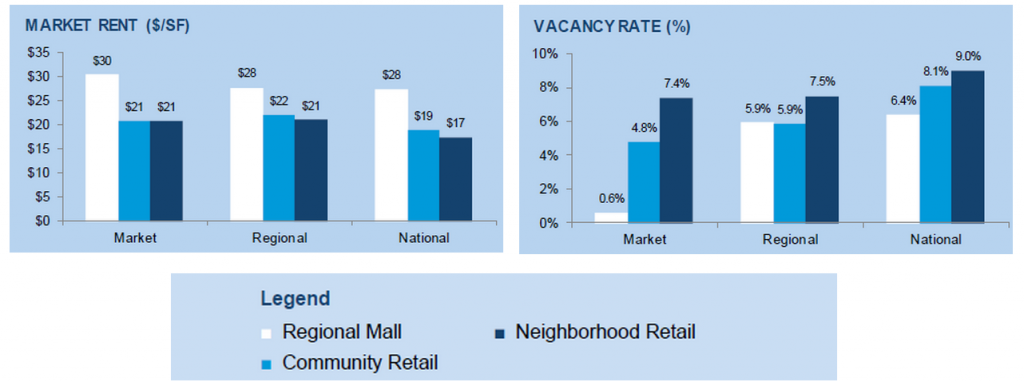

Retail Market Sees Prices Peak

Although it might seem gloomy, the current retail market talk is not necessarily foretelling an imminent industry downturn, even with some analysts equating current market conditions with those in 2007 the current situation is considerably more stable than the pre-bust period last decade, even with current pricing 20% to 30% higher, said Mark Gibson, Executive Managing Director of Dallas-based HFF. Commercial real estate continues to offer more secure returns than virtually any other investment, and investors are now viewing it as a long-term hold, Gibson said.

HFF cited data showing that commercial real estate investor allocations have improved from 9.5% to 13% in the past five years. Moreover, foreign capital investment in U.S. commercial real estate through the second quarter of 2015 had already surpassed all of 2014, Gibson added.

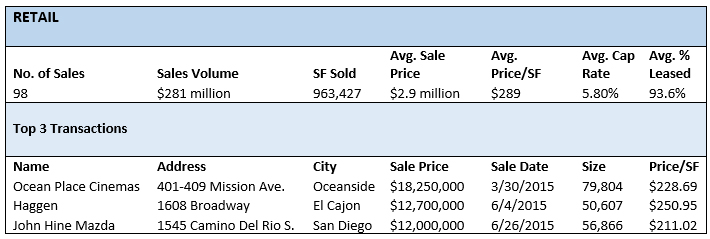

Given its stability, retail real estate offers the best access to inflation protection for investors than any other class, Glenn Lowenstein of Houston-based Lionstone Investments said. Investors are now looking toward opportunities in secondary markets, one panelist said, explaining that because prices are topping out in the 10 biggest U.S. metropolitan statistical areas (MSAs) such as New York, Los Angeles and Chicago, investors are gravitating to quality properties in the top 50 MSA’s.

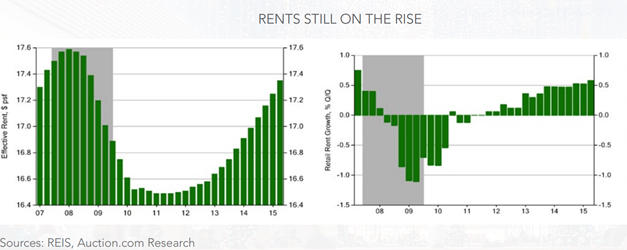

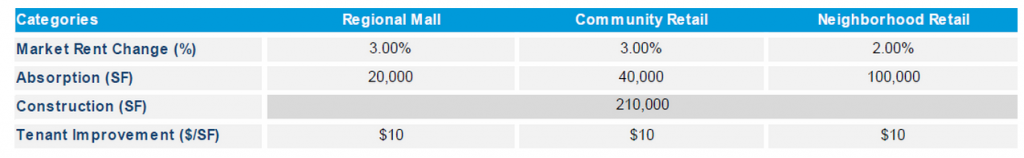

Rent growth is also up at retail properties, driven by lack of supply, panelists said.

Even with the supposed trust in commercial real estate investments, there are still legitimate concerns of excess liquidity and a fear that this will eventually create an asset bubble. The market is now seven years into the recovery — or about the time most cycles begin to play out, said Mark Myers, Executive Vice President and Head of Commercial Real Estate for Wells Fargo Bank of San Francisco. Overall, it would suite investors well to measure opportunities on a deal-by-deal basis.

Slowing Industrial Expansion

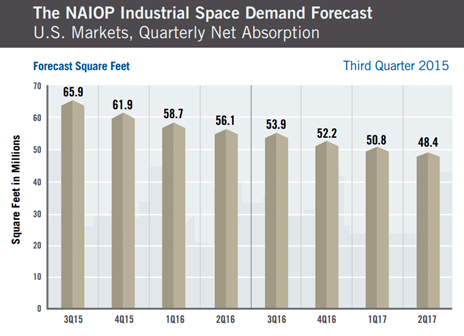

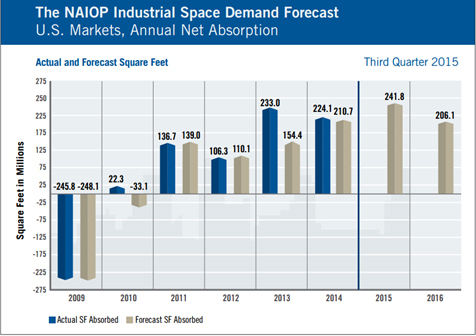

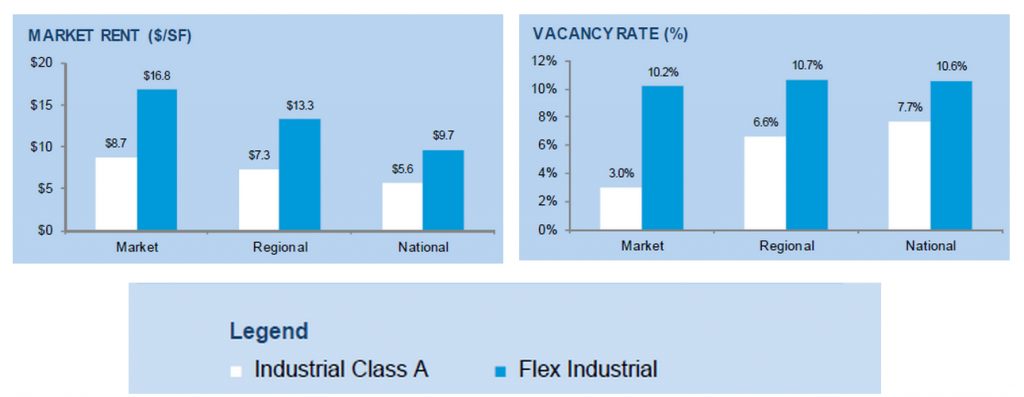

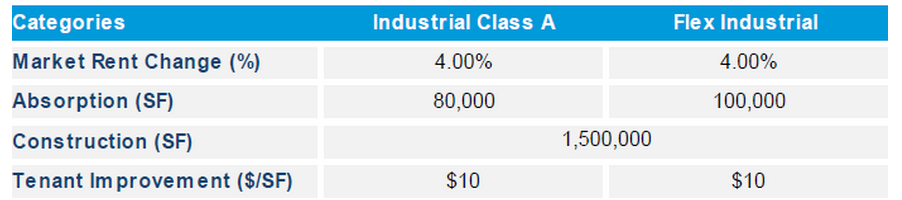

While the U.S. economy remains in slow, moderate growth and many economists cut their forecasts of GDP growth for 2015 and beyond, net industrial demand is still forecasted to remain positive, with over 60 million square feet of quarterly net absorption in the rest of 2015. However, the positive trend is set to begin its decline to rates below 50 million square feet quarterly by late 2016. Said to be impacting the domestic industrial space market, are declines in energy prices and the slowdown in the Chinese economy.

Even though large economic factors are forecasted to have negative effects on the industrial market, there is predicted to still be a large source of new industrial demand going into 2017 from the manufacturing and distribution of consumer goods due to the U.S. employment’s state of steady growth. Consumer goods manufacturing and distribution has seen a steady expansion since the end of the recession, with major retailers such as Amazon and Wal-Mart competing to shorten the click-to-delivery time for online sales – which means more capital must be placed into industrial spaces.

What is yet to be seen is how interest rates will affect industrial demand. If the Fed moves its target short-term rate up by the end of 2015, the rising rate could moderate consumer spending and thereby reduce the demand for consumer goods manufacturing and distribution – meaning less need for industrial space.

Summary

Given the predictions for peaking retail prices and slowing industrial demand, commercial real estate professionals should utilize the data and forecasts to make more prudent decisions on capitalizing and embarking on new deals based on objective measures of future market conditions.

Sources:

ICSC Shopping Centers Today, Retail Real Estate Prices are Peaking, Conference Told, published October 22, 2015

NAIOP Research Foundation, The NAIOP Industrial Space Demand Forecast, Third Quarter 2015 Report