Ah! Spring has sprung!

Spending time outside during changing seasons has a surprisingly strong influence over our general mood and energy level. But most of us spend about 75% of our day, 5 days a week indoors – – – working.

What effect does our workspace environment have on our physical and mental well-being?

Due to tighter regulations and standards, the days of unsafe, unhealthy and unregulated workplaces are gone. But standard operating procedures, equipment updates, and mandates are still crucial in keeping workers healthy.

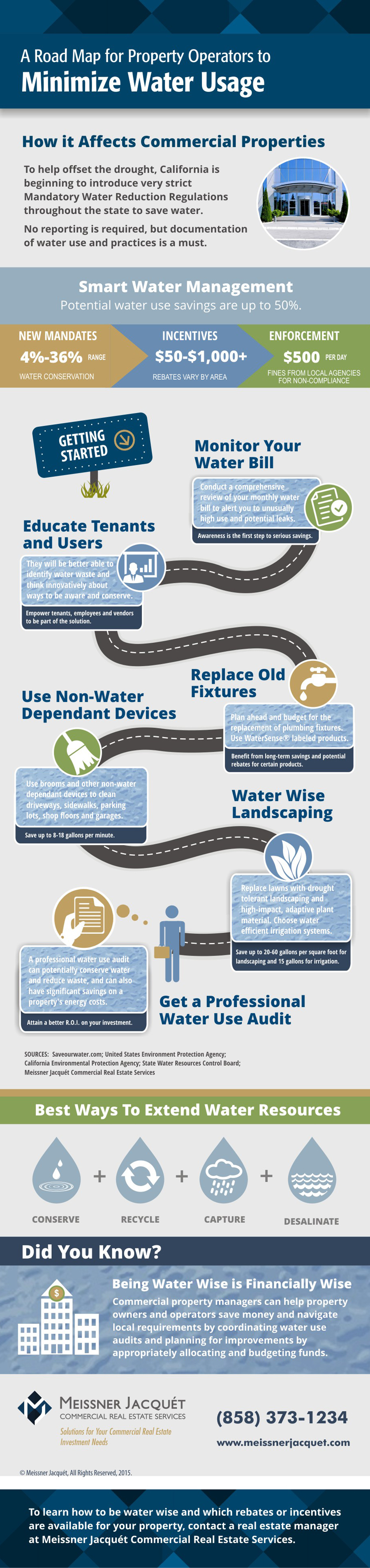

Two regulations in California aim to assist in disclosing new mandates regarding energy use.

California AB 1103

California AB 1103, a Nonresidential Building Energy Use Disclosure Program, mandates that a building’s energy use data and previous year ENERGY STAR rating (as determined by the state board) be disclosed to prospective buyers, lessees and financial lenders prior to the sale, lease, or financing of an entire building.

This regulation came into effect in January 2014 for buildings with a total gross floor area measuring over 10,000 square feet, and will be (as of July 2016) necessary for all buildings with a total gross area of over 5,000 square feet, to be compliant with all stated energy regulations and environmental standards.

Title 24

Also in July of 2014, updated 2013 Standards for Title 24, California’s Building Energy Efficiency Standards for Residential and Nonresidential Buildings, went into effect to reduce California’s energy consumption by incorporating new energy efficiency technologies and methods.

Per ALTA Environmental, with few exceptions, all nonresidential buildings must integrate “manual light dimming and on/off controls, tuning, automatic daylighting (photosensor), and demand response controls in buildings over 10,000 square feet. Use-specific occupant sensing controls are required for a variety of different occupancy use cases. In particular, during a renovation project, existing buildings must meet the new Title 24 Lighting Standards when the project affects at least 10% of existing lighting fixtures, or at least 40 fixtures are modified-in-place.”

What Else Can Germinate Workplace Wellbeing?

In addition to adhering to energy efficiency standards, the goal of many workspace designers is to remove distracting elements from the workplace. By keeping the ambient temperature at predictable, steady levels and controlling lighting, workers are more productive and energy use is more efficient.

But what key component is missing in a majority of workspaces? The answer is natural light. Natural light has been shown to increase happiness and thereby, should positively affect productivity levels.

Bringing in the Green

In addition to natural light, fresh research says that indoor plants benefit workspaces, and people. Natural, living greenery plays a critical role in providing a pleasing, peaceful and rewarding environment.

Studies indicate that live indoor plants:

- Enhance indoor air quality

- Reduce sick building syndrome

- Contribute to overall well-being

- Can boost performance, productivity and creativity

- May decrease stress and temper negative feelings

- Can mitigate noise

- Enliven your business’s appearance

The Norwegian State Oil Company shared the findings of a key study they conducted to exam the effect indoor plants had on the general health of a group of office workers. A quote from the study states, “Data from about 12 different symptoms were collected, including fatigue, headache, dry facial skin and dry skin on the hands, coughing, and eye irritation. After this time, half of the group was provided with a selection of common interior plants and half had none. Over three months, considerably fewer health problems were reported by those people with plants. Fatigue and headache fell by 30% and 20% respectively, hoarseness and a dry throat fell by around 30%, coughing by around 40% and dry facial skin fell by around 25%.”

Plants can also be effective at reducing office noise levels. If the types of plants and their specific location in the workplace are chosen carefully, they can act as sound buffers.

Besides reducing noise and increasing health, indoor plants can improve your business’s perceived personality too. Companies – especially those that have clients who visit often – should invest in a green plant program. Placing plants in the entry areas, offices, meeting rooms and other public spaces gives the office a welcoming, comfortable, and caring appearance.

Pushing Out the Noise

We’ve talked about the calming, cleansing benefit of plants and how they can minimize noise. But plants are hard pressed to stifle the grating, unharmonious noises that can shatter the concentration of workers and cause them real long-term harm – especially in warehouse and production environs.

The Centers for Disease Control and Prevention (CDC) tells us that, “Occupational hearing loss is one of the most common work-related illnesses in the United States. Approximately 22 million U.S. workers are exposed to hazardous noise levels at work, and an additional 9 million are exposed to ototoxic chemicals. An estimated $242 million is spent annually on worker’s compensation for hearing loss disability.”

NIOSH recommends, “… removing hazardous noise from the workplace whenever possible and using hearing protectors in those situations where dangerous noise exposures have not yet been controlled or eliminated.”

Since 2004, the Bureau of Labor Statistics (BLS) has reported that over 125,000 employees have suffered substantial, irreversible hearing loss. The BLS notes that neither surgery nor a hearing aid can help correct this type of hearing loss. Even experiencing short-term, loud noises can bring on a temporary change in hearing or a ringing in your ears (tinnitus). These effects may go away after you leave the raucous area. However, if you work in that type of atmosphere every day the damage may be debilitating.

Jarring noise can also be unsettling mentally. It adds to stress, breaks concentration (which can cause a safety hazard in itself) and interferes with needed communication. Accidents increase and employee discomfort leads not only to health issues, but also to high employee attrition rates.

Warning signs that your workplace may be too noisy:

- You hear ringing or humming in your ears when you leave your workspace.

- You have to shout to be heard by a coworker a short distance away.

- You encounter temporary hearing loss at your workspace.

So how loud is too loud – legally?

According to the standards set by OSHA, “Legal limits on noise exposure in the workplace are based on a worker’s time weighted average over an 8 hour day. With noise, OSHA’s permissible exposure limit (PEL) is 90 dBA for all workers for an 8 hour day. The OSHA standard uses a 5 dBA exchange rate. This means that when the noise level is increased by 5 dBA, the amount of time a person can be exposed to a certain noise level to receive the same dose is cut in half.”

Ensure Employee Safety and Satisfaction

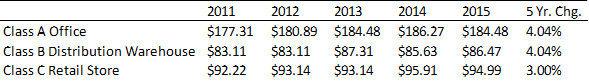

Maintaining compliance with state and local laws and regulations, ensuring building safety and employee comfort, and staying informed of the latest technology trends to ensure profitability can be a full time job for any property owner. Meissner Jacquét Commercial Real Estate Services, a San Diego-based commercial real estate management firm, employs energy management and sustainability practices in its service offerings to clients to address these issues.

Energy conservation and efficiency efforts help reduce property owners’ operating expenses, improve tenant retention by increasing tenant comfort and productivity, and increase asset value. Jerry Jacquet, a Principal at Meissner Jacquét, says that “our property managers identify all sustainable opportunities in order to position our clients’ assets so that they remain competitive in the marketplace, while meeting ownerships’ sustainability goals.”

Entrusting your real estate asset to a qualified, professional commercial property manager will not only keep your building up to standards, but will positively affect your bottom line.

Sources:

Meissner Jacquét Commercial Real Estate Services

Alta Environmental

Green Plants for Green Buildings

First Choice Hearing